Running a small business is challenging. You juggle multiple tasks and financial clarity is crucial for success. This is where accounting firms step in to help. They offer clear insights into your finances and assist with decision-making. A Frisco Tx CPA can be your trusted guide in this process. They help you understand your financial standing with precision. You see where money is coming from and where it’s going. They keep track of expenses, manage taxes, and help you plan for the future. You can focus on growing your business instead of getting lost in numbers. Their expertise ensures you comply with regulations, reducing risks. You gain peace of mind knowing your finances are in capable hands. Having clear financial information helps you make informed choices, ensuring your business thrives. Embrace this support and transform your business’s financial health today with professional guidance.

Understanding Financial Patterns

Accounting firms provide a detailed analysis of your financial patterns. You learn how to spot trends that affect your bottom line. Recognizing these trends early helps you adjust strategies promptly. This proactive approach can prevent financial pitfalls. You understand which products or services generate the most income, helping you allocate resources effectively.

Tax Management Simplified

Taxes are often a major headache for small businesses. Professional accountants make this process easier. They ensure you’re aware of tax obligations and help you maximize deductions. This guidance keeps you compliant with tax laws, avoiding penalties. For more information on small business taxes, you can visit IRS’s Small Business and Self-Employed Tax Center.

Improving Cash Flow

Cash flow problems can cripple a small business. Accounting firms help you improve cash flow by providing a clear financial picture. They assist in budgeting and identifying areas where you can cut costs. This helps you maintain a steady cash flow, ensuring your business remains operational even during challenging times.

Comparison: Managing Finances In-House vs. Hiring an Accounting Firm

| Aspect | In-House Management | Accounting Firm |

|---|---|---|

| Time Investment | High: Requires significant time to manage books and learn regulations. | Low: Frees up your time to focus on business operations. |

| Cost | Varies: May seem cheaper but can lead to costly errors. | Consistent: Fixed costs with potential for savings through expert advice. |

| Expertise | Limited: Depends on personal knowledge and research. | Extensive: Access to professional insights and updated knowledge. |

| Compliance | Risky: Greater chance of missing regulatory changes. | Secure: Ensures compliance with current laws and regulations. |

Strategic Financial Planning

Long-term planning is crucial for growth. Accounting firms help you develop strategic financial plans. They assist in setting realistic goals based on your business’s financial health. This planning positions your business for sustainable growth and helps you achieve milestones efficiently.

Reducing Stress

Managing finances can be stressful. Partnering with an accounting firm reduces this stress. You have experts handling complex financial tasks, giving you peace of mind. Knowing your finances are managed well allows you to focus on what you do best—running your business.

Conclusion

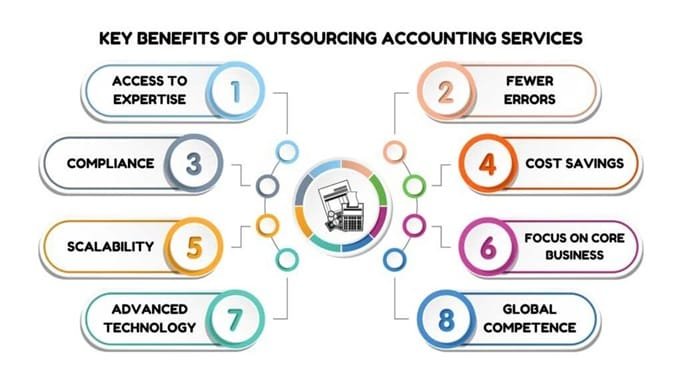

Accounting firms bring numerous benefits to small businesses. They provide clarity, improve financial health, and enable you to make informed decisions. Their services go beyond bookkeeping. They offer strategic insights and ensure compliance with regulations. A professional approach to financial management can be transformative. It allows you to focus on growth and stability. If you’re considering professional assistance, a good place to start is exploring SBA’s guide on managing your finances. Embrace the support of accounting firms and take a significant step towards business success.