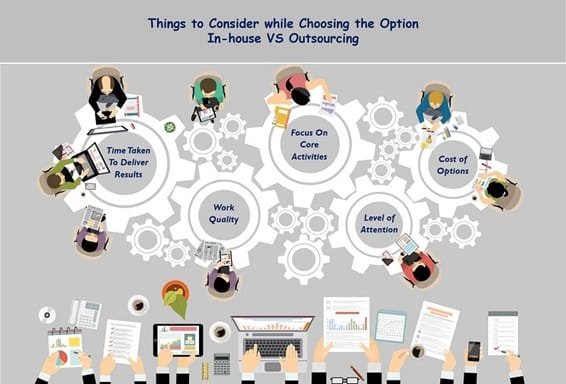

When deciding between outsourcing or maintaining in-house accounting, consider the benefits of each option. Both choices have strengths that can serve your specific needs. Outsourcing provides flexibility and potential cost savings. You hire experts when needed, without the burdens of full-time staff. In contrast, in-house accounting offers consistent attention to your financial details, allowing for personalized service. Your decision should align with your company’s goals and resources. For example, if you’re seeking expertise, a CPA in Huntsville, AL can bring local knowledge and specialized skills to the table. On the other hand, outsourcing can provide a broader range of services from different experts. Consider your priorities. Evaluate factors like cost, control, expertise, and trust. This will guide you to the right choice for your business. Balancing these factors can lead to better financial management and peace of mind as you navigate your company’s future.

Understanding Outsourcing for Accounting

Outsourcing accounting services can be a strategic decision for many businesses. It allows you to access a variety of skills without the commitment of hiring full-time employees. This can be particularly beneficial for small businesses or startups with limited budgets. By outsourcing, you can focus on your core business activities while leaving the financial details to experts. Additionally, it helps in managing workload during peak times, ensuring that your financial statements are always up-to-date.

Exploring In-House Accounting

In-house accounting provides more control over financial processes. The team is familiar with your business operations and can tailor solutions specifically to your needs. Having in-house staff can lead to better communication and quicker decision-making. You gain a team that grows with your business and understands its unique challenges. This option can be more predictable in terms of workflow and can enhance confidentiality, as sensitive financial information remains within the company.

Comparing Costs

| Factor | Outsourcing | In-House |

|---|---|---|

| Initial Costs | Lower | Higher |

| Ongoing Expenses | Variable | Fixed |

| Flexibility | High | Low |

| Control | Less | More |

For a detailed comparison of costs, you can refer to resources provided by the Small Business Administration.

Expertise and Availability

Outsourcing firms often have access to a wide range of professionals with specialized skills. This means you can benefit from their collective knowledge without having to train your staff. They also stay updated on current regulations, reducing compliance risks. However, in-house teams provide dedicated focus on your business. Team members are usually more accessible for urgent issues. They build personal relationships within the company, which can lead to improved morale and engagement.

Evaluating Security Concerns

Security is a major consideration in both options. Outsourcing requires sharing sensitive financial data with external parties, which may present security concerns. To mitigate risks, ensure that the outsourcing firm complies with industry standards and regulations. Conversely, in-house accounting keeps data within the company, which can be advantageous for maintaining confidentiality. Implementing strong internal security measures is crucial to prevent data breaches and unauthorized access.

Making the Right Choice

Your decision should factor in your long-term business strategy. Consider future growth, the complexity of your financial needs, and your available resources. Explore the trade-offs between flexibility and control. Understand the implications of each choice on your company’s financial integrity. For more guidance on making this important decision, visit the Internal Revenue Service website for valuable information and resources.

In conclusion, both outsourcing and in-house accounting have their own merits. Analyze your specific needs and choose the option that aligns with your business goals. Whether you opt for the flexibility of outsourcing or the stability of in-house accounting, ensure that your financial management supports your company’s growth and success.